HUMM Finance

How does humm work?

At humm, we offer a simple and convenient alternative to paying with cash or card for goods from our retail partners. With humm, you can spread the cost of your purchase by applying for a fixed sum loan. Each retailer offers a tailored set of loan terms, so it’s best to check the terms with your chosen retailer by using quote calculator.

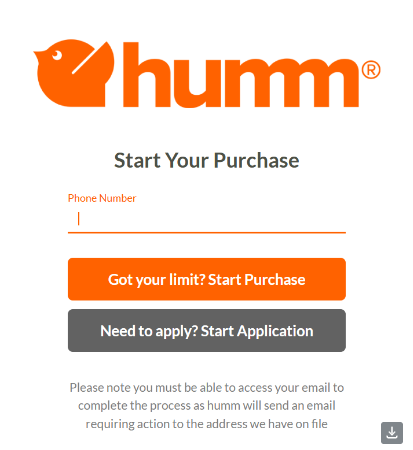

To get started, complete a humm application and we will assess it for you. If you are eligible for credit from humm, you can use the credit to make purchases from one or multiple of our retail partners, both in-store and online.

You will then pay back the loan over the agreed term, making payments to humm based on the terms agreed at the time of the purchase. The first payment is due at the time of purchase, and late payment fees will apply if you do not make a payment on time.

Is humm a responsible lender?

As a lender, humm has a responsibility to make sure we only provide credit to customers who can afford it. It is important that we always make sure that you are using humm in a sustainable way, without causing you financial difficulty.

It would not be responsible for us to lend to everyone, every time they applied for a humm loan, and so we have checks in place to ensure we are able to lend to you in a responsible way.

This means that when you apply to humm, we will review the details provided in your application and also consider your previous credit history, along with other factors. We do this to ensure that we have the best possible understanding of your circumstances to make sure the loan is right for you.

Please be aware that humm’s lending criteria may change over time, and we know that your circumstances may change too. We review every new application, and so if you have repaid a humm loan previously, it does not necessarily mean you will be guaranteed another loan with us.

When your credit history is reviewed as part of the application process, humm will leave a record of our search on your credit file. If you are successful in applying for a loan and sign a credit agreement, we are also required to show this on your credit file. We do this to ensure that other lenders know that you have a credit agreement with humm, so that they can make accurate assessments about your situation too.

Transparency is also an important part of being a responsible lender. This is why humm will always show you the expected total cost of your loan, along with its instalments, before you sign our credit agreement.

humm will only ever charge the interest we agree with you upfront, and any other charges will be clearly explained in your credit agreement.

How much does humm cost?

humm is committed to being transparent about the costs associated with our agreements. You can get an estimate of how much it will cost to borrow using humm using the calculator.

Please note payment terms can differ between retailers, so it’s important to select the right retailer for you.

Please review the payment options carefully when making a purchase through humm, as repayment terms may be subject to change. Ensure that you read and accept the terms and conditions of the agreement before completing your purchase.

Legal Information (FCA Disclaimer)

Project Timber Limited is a credit broker, not a lender and is authorised and regulated by the Financial Conduct Authority (FRN 778622 ). We do not charge you for credit broking services. We will introduce you exclusively to Duologi finance products provided by Specialist Lending Ltd t/a Duologi through the HUMM platform.

Note : 0% finance with a term of 12 months or less is not regulated by the Financial Conduct Authority.

Learn more about humm

Visit site for more details. Click here to visit humm website.