What you need to know

Used responsibly, finance is a great way to spread the cost of your purchase. We’ve teamed up with Deko, whose secure technology lets you complete a loan application with one or more carefully selected lenders quickly and easily. Deko is a credit broker, not a lender and is authorised and regulated by the Financial Conduct Authority. Find out more about how Project Timber Limited and Deko are regulated. under the “Legal Information” section of this page. You can find out more about Deko below

https://www.dekopay.com/for-customers

Deko connects you with lenders whose finance options are best suited for you and your purchase. As a customer of Project Timber Limited your finance application will be considered by Specialist Lending Limited trading as Duologi.

To spread the cost of your purchase, simply choose Deko at the checkout and select the finance option that suits you. The application form is quick and simple and includes help text throughout to assist you. You will receive a decision from your lender in just a few seconds.

Please be aware that finance options are a form of credit. If you fail to maintain your payments, your lender could ask a debt collector to contact you or commence legal action to recover the money you owe. A poor repayment record will affect your credit file.

Lender Arrangements

All of Deko’s lenders hold the required authorisation and permissions to provide you with credit. They need to meet high responsible lending standards, so you can rest assured that your application will be considered fairly and responsibly.

Whichever lender Deko introduces you to, Deko may receive a commission from them (either a fixed fee or a fixed percentage of the amount you borrow). The lenders Deko works with pay commission at different rates, but the commission received does not influence the interest rate you pay. You will be offered the best rate available from Deko’s partner lenders, based on the lenders’ decision policies. You have the right to know the amount of commission paid in relation to your application – if you’d like this, you can ask Deko’s customer support team on support@dekopay.com or by phone on 0800 294 5891.

Check your eligibility

- To be considered for finance, you will need to meet all of the following criteria:

- Are at least 18 years old

- Are in regular full or part-time employment (minimum 16 hour per week or £10,000 income per annum), unless you are retired and receiving a private or company pension, or you are in receipt of disability living allowance

- Are a permanent UK resident and have lived in the UK for at least 3 years

- Have a UK bank account capable of accepting Direct Debits

- Have a good credit history with no late payments, Debt Relief Orders, County Court Judgments or bankruptcies.

Available Finance options

We offer a range of interest-free and interest-bearing finance options to help you spread the cost of your purchase over 12 to 60 months . The value of the loan needs to be over £500 and no more than £15,000 and you can choose a deposit of up to 50% of the value of the goods.

Understanding the numbers

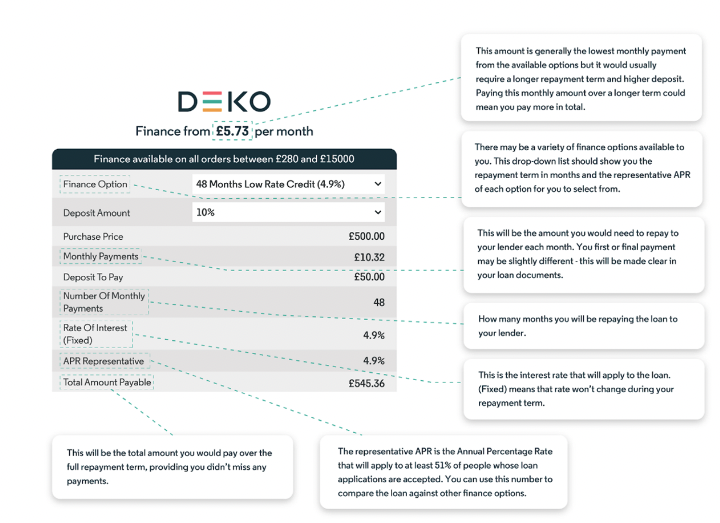

Deko wants to make sure that you understand the costs, terms and key features of the finance options available to you. You will see this information as you shop and at checkout.

Use our finance calculator at checkout to see how different loan values, terms and interest rates affect the total amount you need to pay and the monthly repayments. The finance calculator is for illustrative purposes only and is not a quote, or formal offer of finance. The offer you receive if you apply will be dependent on your personal circumstances and the lender’s policies.

It’s important that you understand what this information means for you before you decide to apply for finance. The numbers and information you see when taking out finance can be overwhelming and so Deko has provided a simple guide below to help you.

Here is an example of what you might see at checkout, with some handy explanations to help you understand what it all means. Please note that this is just an example, the format, layout and content of checkout finance calculators may vary.

Use our finance calculator to check the impact of various loan values, terms and interest rates on the total amount you need to pay and the monthly repayments.

Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments. You should think about any changes to your situation that might occur during the term of the loan, which could impact on your finances – e.g. retirement, moving home, changing jobs, or any health issues which could affect your income or expenditure.

Alongside the finance calculator and on some of our promotional banners, you will also see the representative example. This could be written in a sentence, as shown in the example below, or in a table format:

Representative example

Cash price £500.00, Deposit £50.00. Total amount of credit £450.00 over 48 months with an annual interest rate of 4.9% (Fixed). Monthly repayments will be £10.32 with a total repayable of £545.36. 4.9% APR representative.

The representative example shows the finance information that we expect to apply to more than half of accepted applications for the specific amount and repayment term.

As we mentioned earlier, the representative example is not a quote or formal offer of finance – we display this to help you understand how much a loan will cost, and so you can compare it with other products.

Whilst these numbers are there to help you understand what a loan will cost you, it’s important that you understand any other potential costs in the terms and conditions of the finance option you select. For instance, you may be charged missed or late payment fees if you don’t keep up with your payments.

FAQ’s

Finance Decision

Will I be accepted for finance?

Your application will be assessed based on eligibility, credit history and affordability and Deko will let you know the outcome in just a few seconds. Your lender will perform a ‘soft’ credit search on your credit file as part of their assessment, to determine whether the loan is affordable for you and if you are likely to make your repayments on time.

It’s important to know that if your application is accepted, a ‘hard’ credit check may be made on your credit file. Only you can see that a ‘soft’ search has been made on your credit file, but a ‘hard’ credit check will be visible to others viewing your credit file, for example, if you apply for credit in the future, the lender will see that an application credit search was made on your credit file.

In a few cases, your application may be referred to a lender for manual assessment and you’ll be notified by email of the credit decision within 24 hours.

What do I do if I have been declined?

If your application was declined, your lender may be unable to give you specific reasons why. Lenders use information from your credit report, alongside your income and expenditure data to make a lending decision. If you feel that there has been a mistake, please contact your lender – their contact details will appear on the email informing you that your application was declined.

You can also contact the Credit Reference Agencies if you think there is a mistake on your credit report:

Your Loan Agreement

Before signing your credit agreement, you will be given some important documents that include key information about your loan. It is important that you read these documents and understand the information and key terms. If you have any questions about the information in your credit agreement before you sign it, Deko’s customer support team can help – you can contact them on support@dekopay.com or by phone on 0800 294 5891. They are open Monday to Friday from 8am to 8pm.

Who should I contact if I have a question about my loan?

For any questions about your loan, such as your Direct Debit or updating your personal details, please contact your lender. Their contact details will be provided throughout your application and on any communications you receive about your finance application.

I’m having problems paying my deposit online

Please contact Deko customer support at support@dekopay.com or 0800 294 5891. They are open Monday to Friday from 8am to 8pm.

When will I receive a copy of my loan agreement?

You will be presented with an unsigned copy of your credit agreement for you to sign once your lender has made their decision. Once you have signed your credit agreement, your lender will also sign it and a copy will be available for you to download. These will also be emailed securely to your given email address.

If you need a copy of your agreement at any point after this, you can request this from your lender.

The terms of your loan agreement will set out your right to withdraw. You may be able to withdraw from your loan agreement within 14 days. However, if you do so, you will still be responsible to pay for your goods by another payment method.

Payments and Order

How do I make my monthly payments?

Your lender will help you set up convenient, pre-authorised payments via your bank account or your credit/debit card.

Can I request delivery to an address other than my home address?

In order to safeguard against fraudulent applications, we are only able to deliver goods to your home address.

I want to amend my order.

If you have been approved for finance, the amount or term cannot be amended. You will need to contact us (your retailer) to amend the goods or services you ordered and you may need to complete a new application for finance. Please note we cannot guarantee a new credit application will be approved.

I haven’t received my goods or service.

Please contact us at sales@projecttimber.co.uk and we will help you.

I want to change my Direct Debit details.

Changing your payment date can only be done once the first payment has been taken. Please contact your lender to talk to them about updating your Direct Debit details.

Are there any fees or charges to pay?

There is no fee for processing your application, and Deko does not charge you for its credit broking services.

Fees will be payable to your lender if you fail to maintain your repayments. Fees and charges may include late payment fees and administration/letter fees if you are issued an arrears or default notice. Full details of all fees and charges will be set out in the terms of your credit agreement.

Cancellations and Returns

I want to return my goods and cancel my finance agreement.

Please see our Return Policy. Some products cannot be cancelled, for example, made-to-order or bespoke goods, so you should check this before you complete your purchase.

Where you do have the right to cancel, you must do this within 14 days of entering into the finance agreement.

To cancel your finance agreement, please contact us (your retailer) and arrange to return your purchase or cancel the services. Once we have confirmed cancellation, we will advise your lender to cancel your finance agreement and refund any payments that have been made. If you made your purchase in-store, we will refund any deposit payment that you made. Your finance agreement can only be cancelled by your lender if your purchase is cancelled with us.

What happens to my loan if I want to return my order?

If you are not satisfied with your purchase you can return it up to 30 days after delivery. In this case, we will notify your lender to reduce your loan amount accordingly. You will receive confirmation from your lender within 3-5 business days after we received your return in cases where a full refund is processed.

Can I withdraw from the credit agreement and pay by a different method?

You have the right under section 66A of the Consumer Credit Act 1974 to withdraw from the agreement without giving any reason before the end of 14 days (beginning with the day after the day on which agreement is made or, if later, the date on which the lender will tell you that they have signed the agreement). If you wish to withdraw you must give your lender notice in writing or by telephone or email. The name and contact details of your lender will be clearly shown on your credit agreement.

Please note that if you do give notice of withdrawal, you must repay the whole of the credit without delay and in any event by no later than 30 days after giving notice of withdrawal. You will also have to pay interest accrued from the date the agreement was made until the date you repay it.

Your Personal or Financial Circumstances

It’s a fact of life that things can change for any of us. If something changes in your personal, or financial circumstances, Deko and your lender will do all they can to help make it as easy as possible to submit your application and manage your loan repayments.

If you’re struggling at any point with your application online, or you don’t understand anything, please contact Deko’s customer support team at support@dekopay.com or 0800 294 5891.They are open Monday to Friday from 8am to 8pm

If you find yourself struggling due to a change in your circumstances, please contact your lender and ask for their help.

Use of Your Personal Data

In order to process your application, you will be asked to provide information about your personal, employment and financial situation. Deko share your personal data with their partner lenders so that they can make a decision about whether to offer you finance. Lenders perform a search with one or more Credit Reference Agencies to conduct their creditworthiness and affordability assessment to enable them to make their decision.

You can find out more about how Deko uses and protects your personal data in their Privacy Policy

Your lender will let you know where you can find more information about their privacy policy.

Still have questions?

If you still have questions about your finance application or need some help completing it, check out Deko’s FAQs here.

For any questions related to finance, please contact your lender. Their contact details will be provided throughout your application and on any communications, you receive about your finance application.

Legal Information (FCA Disclaimer)

Deko’s registered office address is: Pay4Later Ltd (t/a Deko), 100 Liverpool Street, London, EC2M 2AT

Note : 0% finance with a term of 12 months or less is not regulated by the Financial Conduct Authority.